Transfer By Voluntary Alienation

TRANSFER BY VOLUNTARY ALIENATION

Deeds

Wills

Deeds Parties. A deed is a legal instrument used by an owner, the grantor, to transfer title to real estate voluntarily to another party, the grantee.

A deed is used when a title is voluntarily transferred by the sale or gift from the property owner to another party. The property owner must be alive for this 196 Principles of Real Estate Practice in Florida

transfer. For example, if the owner sells the property, the transfer takes place with a deed. If the owner donates the property to a charity, the transfer takes place with a deed.

Delivery and acceptance. Execution of a valid deed in itself does not convey title. It is necessary for the deed to be delivered to and accepted by the grantee for title to pass. To be legally valid, delivery of the deed requires that the grantor

be competent at the time of delivery

intend to deliver the deed, beyond the act of making physical delivery

Validity of the grantee’s acceptance requires only that the grantee have physical possession of the deed or record the deed.

Once accepted, title passes to the grantee. The deed has fulfilled its legal purpose and it cannot be used again to transfer the property. If the grantee loses the deed, there is no effect on the grantee’s title to the estate. The grantor, for example, cannot reclaim the estate on the grounds that the grantee has lost the deed after it was delivered and accepted. Nor can the grantee return the property by returning the deed. To do so, the grantee would need to execute a new deed.

Voluntary transfers in Florida. The general procedure for transferring title in Florida consists of the following steps. Deeds are discussed later in this section.

locate the current deed that includes the property’s legal description and the exact name of the current grantor

prepare the new deed to include all required information

sign and notarize the deed; the deed must be signed by the grantor, any spouse with homestead rights, and two witnesses; it must also be notarized

file the deed with the county clerk in the county where the property is located; filing may include recording fees or documentary stamp taxes

Deeds are treated in greater detail later in this section.

Wills Parties to a will. A will, or more properly, a last will and testament, is a legal instrument for the voluntary transfer of real and personal property after the owner’s death. It describes how the maker of the will, called the testator or devisor, wants the property distributed. A beneficiary of a will is called an heir or devisee. The property transferred by the will is the devise. “Devise,” “devisor,” and “devisee” refer more specifically to real property transfers, while “bequest” and “beneficiary” are sometimes limited to transfers of personal property.

A will takes effect only after the testator’s death. It is an amendatory instrument, meaning that it can be changed at any time during the maker’s lifetime. Section 9: Title, Deeds, and Ownership Restrictions 197

Commonly, the testator names an executor, or personal representative, to oversee the settlement of the estate. If a minor is involved, the testator may identify a guardian to handle legal affairs on behalf of the minor.

Types of will. A will generally takes one of the following forms:

witnessed

in writing and witnessed by two people

holographic

in the testator’s handwriting, dated and signed

approved

on pre-printed forms meeting the requirements of state law

nuncupative

made orally, and written down by a witness; generally not valid for the transfer of real property

Validity. State law establishes requirements for a valid will. Florida law requires that:

the testator be of legal age and mentally competent

the will be signed

the completion of the will be witnessed and signed by the witnesses

the will be completed voluntarily, without duress or coercion

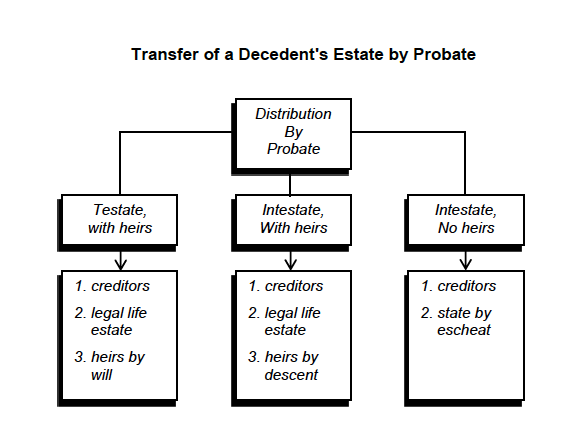

Probate. A court proceeding called probate generally settles a decedent’s estate, whether the person has died testate (having left a valid will) or intestate (having failed to do so). Real property may be exempted from probate if it is held in a land trust. Probate of real property occurs under jurisdiction of courts in the state where the property is located, regardless of where the deceased resided.

The probate court’s objectives are to:

validate the will, if one exists

identify and settle all claims and outstanding debts against the estate

distribute the remainder of the estate to the rightful heirs If the will does not name an executor, the court will appoint an administrator to fulfill this role

Testate proceeding. If the decedent died with a valid will, the court hears the claims of lienors and creditors and determines their validity. First in line are the superior liens: those for real estate taxes, assessment taxes, federal estate taxes, and state inheritance taxes. If the estate’s liquid assets are insufficient to pay all obligations, the court may order the sale of personal or real property to satisfy the obligations.

The court must also hear and satisfy legal life estate claims, including those for dower, curtesy, homestead, and elective share. These interests may prevail even if the will does not provide for them.

Once all claims have been satisfied, the balance of the estate’s assets passes to the rightful heirs free and clear of all liens and debts.

Intestate proceeding with heirs. If the decedent died without a valid will, the estate passes to lawful heirs according to the state’s laws of descent and distribution, or succession. Laws of descent stipulate who inherits and what share they receive, without regard to the desires of the heirs or the intentions of the deceased.

For example, John Astor dies intestate, leaving a wife and four children. Under Florida law, the surviving spouse receives the entire estate as long as all four children are descendants of both the decedent and the surviving spouse and there are no other children of either spouse.

Intestate proceeding with no heirs. If an intestate decedent has no heirs, the estate escheats, or reverts, to the state after all claims and debts have been validated and settled.